Keeping tabs on your summer program performance is easy with daily management reports from Knopman Marks. These reports clearly summarize the information you need to keep managers and interested parties in the know on program progress.

Your report for the day’s training will be emailed to you by the instructor or teaching assistant assigned to the class. We strive to deliver the information to you no later than 7 p.m. of that training day so you are prepared for any questions that may come your way and can reach out to students as needed.

Many summer programs include more than one exam prep class, and reports are provided for each. The format of each report and the features are similar, although the number of testing experiences may vary based on the length of your program.

Reading Your Summer Program Report

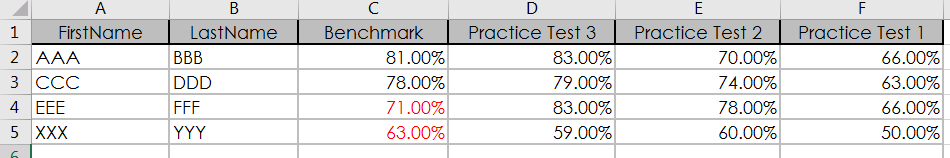

Below is a sample of a Series 7 summer program report. It lists student names on the left and includes columns for exams that are administered during class. These exams have a proven ability to identify students that may be “at risk”, and our objective is to provide you the information you need to plan appropriately.

Our Series 7 summer programs generally include 4 exam experiences, as shown in the excerpt above. On the first day we will report on Practice Test 1 (see far right), and the Benchmark score will be reported on the final day. Normally, performance improves each day as the student benefits from class and additional practice questions.

The minimum expectations for each S7 program exam are below:

Day 1 Exam Minimum Score: 60%

Day 2 Exam Minimum Score: 65%

Day 3 Exam Minimum Score: 70%

Benchmark Exam Score: 75%

This ideal score progression is not achieved by every student for a variety of reasons. The overall trend, however, is important.

The report above was prepared after the final day of class. The benchmark score is highlighted for persons that are falling below the score objective of 75%. Through rigorous testing, Knopman Marks has determined that It is unlikely for persons that achieve 75% or more on the benchmark to fail the actual exam. However, scores can go either way for those that don’t hit the objective, and you may wish to consider postponing the test date for these students. Particularly at risk are those that are scoring below 70% and are testing the next day.

Some students can gain a significant amount of ground in a short time and may achieve a passing score, in spite of a low benchmark score, but others may benefit from extra time to study. Instructors are always available to help counsel students and also discuss next steps with you when you have concerns over whether or not to postpone exam appointments.

Our Pledge for Program Support

As your partner, we are determined to provide you the information you need to make the right decision for you program. With our proven resources and expert instructors, you can count on the reports we provide to set performance expectations appropriately.

Don’t hesitate to contact your instructor or teaching assistant to discuss next steps and individual action plans for underperformers. Instructors are available to provide personalized guidance for students that are at risk, and are always willing to share their recommendations with you and others that may need this information.